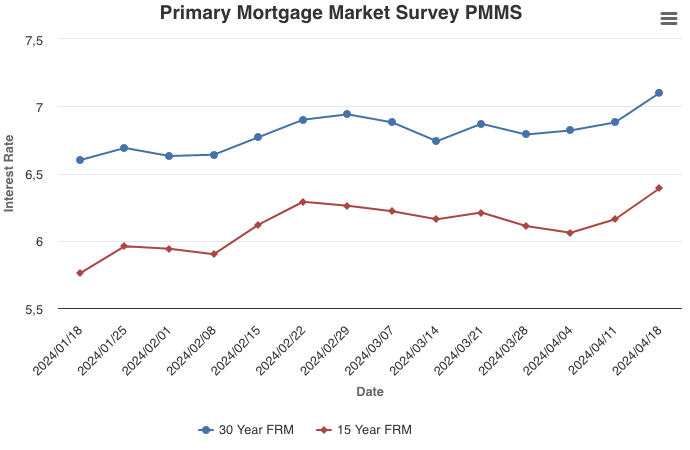

April 18, 2024

The 30-year fixed-rate mortgage surpassed 7 percent for the first time this year, jumping from 6.88 percent to 7.10 percent this week. As rates trend higher, potential homebuyers are deciding whether to buy before rates rise even more or hold off in hopes of decreases later in the year. Last week, purchase applications rose modestly, but it remains unclear how many homebuyers can withstand increasing rates in the future.

Information provided by Freddie Mac.